Income Tax Slab for AY 2024-25: Boosting Middle-Class Income Tax Relief

Table of Contents

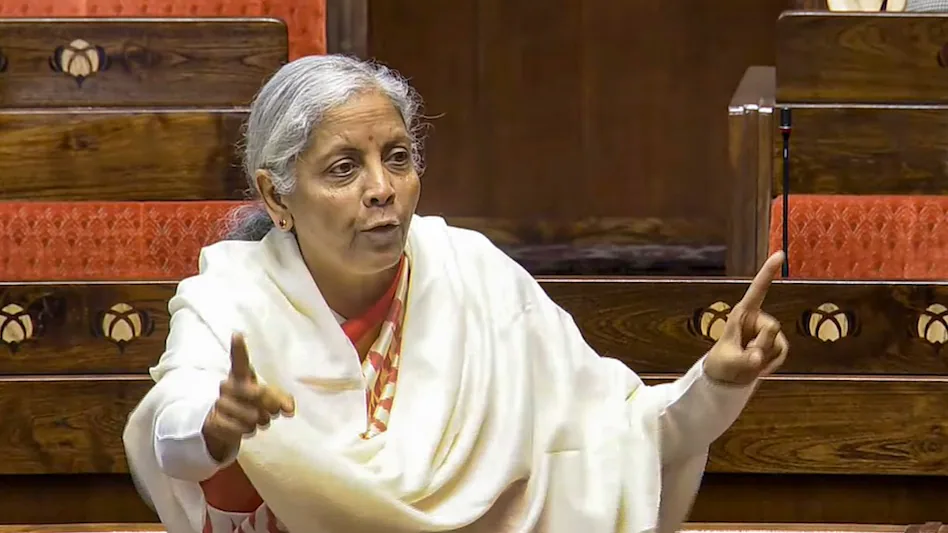

In a move aimed at providing financial relief to the middle class, Finance Minister Nirmala Sitharaman addressed taxpayers with a focus on alleviating the financial pressures that many families are facing in India today. In her address, she acknowledged the struggles of the middle-class population and outlined a series of tax adjustments that were included in the most recent Budget. These changes are designed to help put more money in the pockets of middle-class individuals,

thereby offering financial relief without overstretching the government’s fiscal capabilities. The key proposal that stands out is the increase in the standard deduction from ₹50,000 to ₹75,000 for salaried individuals, a step that represents a significant boost to income tax relief for millions of taxpayers. Income Tax Slab for AY 2024-25

Tax Relief for Middle-Class Taxpayers

Sitharaman’s remarks underline her commitment to easing the tax burden on the middle class. She recognized that while taxation remains a necessary tool for national development, there are inherent limitations to the extent to which taxes can be imposed, particularly on the middle-income group. The middle class often feels the pinch of rising living costs and economic instability, and Sitharaman assured that the government is actively considering options to provide broader income tax reductions, specifically for individuals earning up to ₹15 lakh annually. This move aligns with the government’s goal of boosting consumption, a crucial factor in sustaining economic growth, especially amid an ongoing slowdown.

The move to revise the tax structure is particularly important as it directly impacts the disposable income of taxpayers, offering them more flexibility in managing their finances. This is especially critical in the current economic environment, where many middle-class individuals are grappling with higher living costs and economic uncertainties. By lowering the tax burden, the government hopes to stimulate spending, which, in turn, could help revive demand across various sectors of the economy. Income Tax Slab for AY 2024-25

Incremental Relief Across Various Tax Brackets

The government’s proposed changes extend to multiple income brackets, providing incremental relief to a wide spectrum of taxpayers. These reforms would primarily benefit those opting for the 2020 tax regime, where income between ₹3 lakh and ₹15 lakh is taxed at rates of 5% to 20%. For those earning higher incomes, the tax rate stands at 30%. The increase in the standard deduction and the reduction in income tax rates would significantly lower the tax liabilities for individuals within these income bands. Income Tax Slab for AY 2024-25

The key aspect of this reform is the targeted approach in benefiting both middle- and higher-income groups. By revising tax rates and increasing the standard deduction, the government is attempting to make the tax system more progressive, where the financial relief is distributed fairly across various income levels. This is especially beneficial for middle-income earners, who often find themselves caught in a tax bracket that burdens them more heavily compared to lower-income earners, even though their disposable income remains limited.

Targeted Income Tax Relief for Individuals Earning up to ₹15 Lakh

The most notable change under consideration is the government’s plan to introduce broader income tax reductions for individuals earning up to ₹15 lakh annually. This is a direct response to the mounting financial pressure faced by urban taxpayers who often have to cope with high living costs, including expenses related to housing, education, and healthcare. Income Tax Slab for AY 2024-25

The proposed changes would benefit a significant portion of the workforce, particularly those in metropolitan areas where income levels are higher but so are the costs of living. By offering tax relief to individuals earning up to ₹15 lakh, the government aims to put more disposable income into the hands of this critical demographic, thus stimulating demand in the economy. This is in line with the government’s broader goal of stimulating consumption, which has been sluggish due to various factors, including inflation and slower economic growth.

These changes could also help reduce the income inequality that exists within the country, as the middle and higher-income groups are often subjected to disproportionate tax burdens. By easing the tax load on these groups, the government seeks to foster greater economic equality while promoting higher consumption levels, which would benefit various sectors of the economy.

Holistic Financial Relief: Beyond Income Tax

In addition to the proposed changes in income tax rates, Sitharaman also highlighted several other key measures aimed at providing financial relief. These initiatives focus on areas such as education, affordable housing, and overall financial stability for families. For instance, one of the major proposals includes subsidized interest rates for student loans, allowing students to borrow up to ₹10 lakh at reduced interest rates. This is a critical move as education remains one of the biggest financial burdens for families, particularly in urban areas where tuition fees and other related costs can be prohibitively expensive.

Another significant measure is the support for affordable housing. The government is aiming to make housing more accessible for middle-class families by introducing measures that would reduce the financial barriers to homeownership. This is especially important in light of the increasing costs of real estate in urban areas, where many middle-class individuals find themselves priced out of the housing market. By subsidizing interest rates and offering other financial incentives, the government aims to make housing more affordable and reduce the financial strain on families.

These initiatives form part of a broader strategy to provide holistic financial relief. They acknowledge the various pressures that middle-class families face and seek to ease those burdens by offering support in areas beyond just taxation. By addressing key concerns such as education and housing, the government aims to provide comprehensive support that can enhance the quality of life for middle- and high-income groups.

Economic Context: Slower Growth and Rising Inflation

The context for these proposed tax changes is the slower economic growth that India has been experiencing in recent quarters. Between July and September, India’s economic growth slowed to its weakest pace in seven quarters, a concerning trend that has been exacerbated by high food inflation. This inflation has reduced consumer demand for goods and services, as rising food prices have stretched household budgets. The impact of inflation is felt most acutely by middle-class families, who often have limited scope to absorb such price hikes due to their relatively fixed incomes.

The growing number of taxpayers earning between ₹50 lakh and ₹1 crore highlights the increasing financial pressures faced by middle- and high-income groups. Over the last decade, this segment of taxpayers has surged by a staggering 440%, pointing to the growing income inequality and the challenges that middle-class families face in an economy characterized by rising costs and slower growth. Income Tax Slab for AY 2024-25

The Government’s Focus Moving Forward Income Tax Slab for AY 2024-25

The upcoming budget will likely focus on these key issues: addressing the financial challenges of middle-class taxpayers, boosting consumption, and navigating the ongoing economic challenges with targeted measures. With the increased burden on middle-class families due to inflation and rising living costs, the government is focusing on providing immediate relief through tax adjustments and other financial support measures.

The key takeaway from these proposals is the government’s acknowledgment of the growing financial strain on the middle class and its efforts to provide targeted relief without jeopardizing the government’s fiscal health. By providing tax relief and exploring broader tax reductions, the government aims to stimulate economic activity and support families in navigating their financial challenges. Income Tax Slab for AY 2024-25

Conclusion Income Tax Slab for AY 2024-25

As Finance Minister Nirmala Sitharaman outlined tax tweaks in the latest Budget, it is clear that income tax relief remains a key priority for the government. The increase in the standard deduction and the potential for broader income tax reductions offer much-needed financial relief to middle-class taxpayers. Alongside these tax changes, the government is also introducing holistic financial relief measures, such as support for education and affordable housing, to address the diverse needs of middle-class families. Income Tax Slab for AY 2024-25

As India continues to grapple with slower economic growth and rising inflation, these measures reflect the government’s commitment to easing financial pressures and stimulating consumption. By addressing the growing financial burdens on middle- and high-income groups, the government hopes to foster economic stability and growth in the coming years.

Source Income Tax Slab for AY 2024-25

Dailyread Income Tax Slab for AY 2024-25